COBRA vs Private Health Insurance in 2026: Which Makes More Sense After Leaving a Job?

- Nicholas Kuhl

- Nov 11, 2025

- 3 min read

Updated: Nov 18, 2025

Losing employer coverage can feel overwhelming. Between COBRA paperwork and private plan options, most people aren’t sure which direction to go — or how to tell what’s actually worth the cost.

Let’s break down how COBRA vs Private Health Insurance really compares in 2026 so you can make a confident, informed decision.

What Is COBRA Coverage?

COBRA (the Consolidated Omnibus Budget Reconciliation Act) lets you temporarily continue your employer’s group health plan after leaving your job.

The main advantage:

You keep the exact same plan — same doctors, same benefits, same coverage.

The downside:

You now pay the entire premium yourself, plus a 2% administrative fee your employer used to cover.

For many families, that means going from a $300 payroll deduction to a $900–$1,200 monthly bill.

COBRA can make sense if:

You’re in the middle of treatment or pregnancy

You’ve already met your deductible or out-of-pocket max

You need short-term continuity while waiting for new employer coverage

Otherwise, it’s often an expensive temporary fix.

What Is Private Health Coverage?

Private coverage — such as Private PPO plans — comes directly through independent carriers rather than your employer.

These plans are designed for self-employed professionals, families, or anyone without job-based insurance.

Key advantages:

Often 40–60% lower premiums than COBRA (for healthy applicants)

Nationwide PPO networks — keep your doctors anywhere in the U.S.

Customizable coverage — choose benefits that actually fit your needs

Available year-round (not just during open enrollment)

The trade-off is that most private plans use basic health questions for approval — so they’re best suited for people in generally good health.

2026 Comparison:

COBRA vs Private PPO Health Insurance 2026

Feature | COBRA Coverage | Private PPO Coverage |

Monthly Cost | Full employer rate + 2% admin fee | Often 40–60% lower |

Network | Same as employer plan | Nationwide PPO (varies by carrier) |

Enrollment | Within 60 days of job loss | Anytime (year-round) |

Eligibility | Guaranteed | Health-based (simple questions) |

Duration | 18–36 months | Indefinite |

Flexibility | Limited | Fully customizable |

Real-World Example

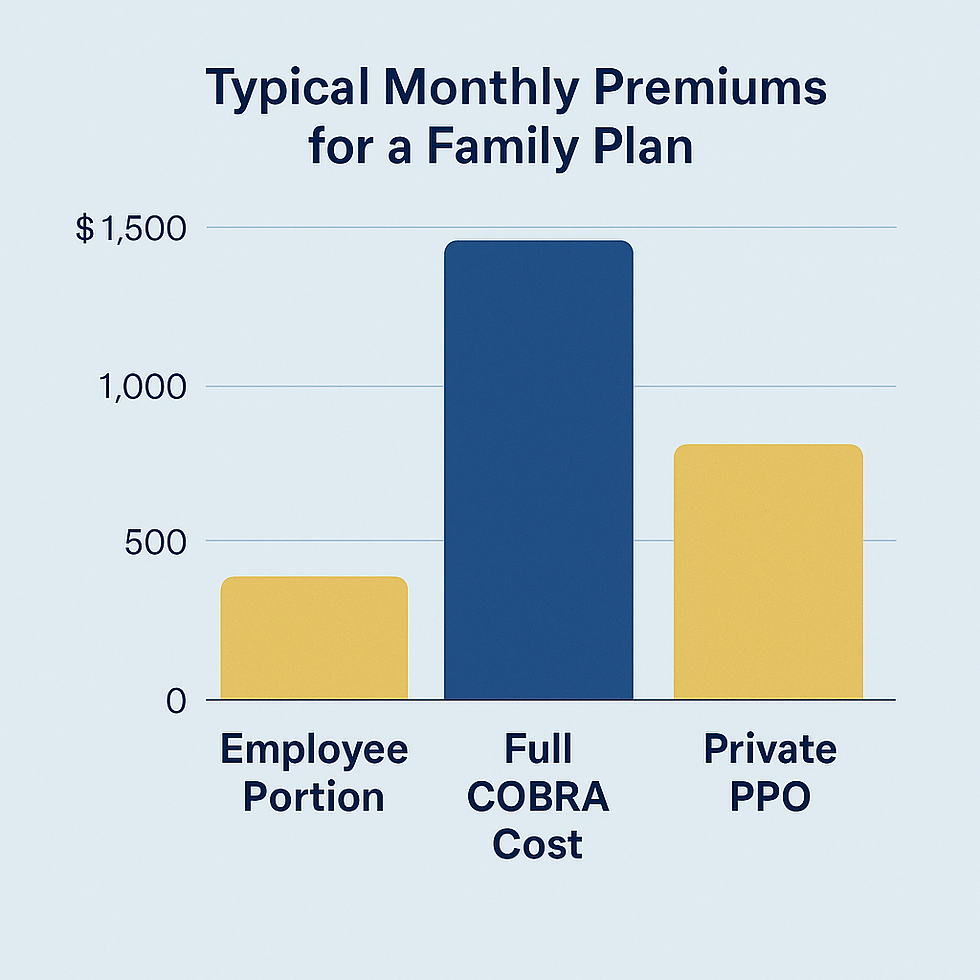

Let’s say you were paying $350/month for your share of an employer plan, and your company paid $700.

Once you leave that job, COBRA means paying the full $1,050 — plus a small admin fee.

A comparable private PPO could run $450–$600/month with similar or better coverage, depending on your age, household size, and state.

That’s often a savings of $500+ per month, or over $6,000 a year — money most families would rather keep.

Which Option Fits You Best?

When you want to compare COBRA vs Private Health Insurance in 2026, if you’re between jobs, starting a business, or going 1099, private coverage usually makes more sense long-term.

COBRA is best as a bridge — not a destination.

Ask yourself:

Do I expect to have new coverage within 2–3 months?

Am I relatively healthy?

Do I need nationwide coverage or out-of-state flexibility?

Is saving $400–$600/month worth switching now?

If you answered yes to most, a private PPO is worth reviewing.

Final Thoughts

COBRA was designed as a temporary safety net — not a long-term solution.Private coverage, on the other hand, gives you more control, flexibility, and affordability once you’re no longer tied to an employer plan.

Enjoying these insights?

Follow Coverage by Kuhl on Facebook for simple, honest health coverage tips, Marketplace updates, and private PPO guidance — posted weekly.

Written by Nicholas Kuhl, Licensed Health Advisor — CoverageByKuhl.com

If you recently lost employer coverage, schedule a quick review to compare your COBRA and private options before your 60-day window closes.

Comments